Boi Filing 2025 Fincen Form

Boi Filing 2025 Fincen Form. What do company owners and executives need to know about fincen’s new boi reporting requirements? Companies created in 2025 have 90 days from their creation date to file boi reports, while the deadline for companies created before 2025 is jan.

Thanks to the corporate transparency act, starting jan. Missing a boi filing deadline to report beneficial ownership information can lead to compliance issues and possible fines.

Fincen Form 114 2025 Date Nixie Angelica, That’s also where all updates and corrections will be filed.

FinCEN Beneficial Ownership Information Filing (BOI) 2025 Who, What, Starting in 2025, many entities created in or registered to do business in the united states will be required to report information about their beneficial owners—the.

The Definitive Guide to the Corporate Transparency Act (CTA) and, Subsequent treasury regulations set the effective date of the cta's requirements as january 1, 2025, meaning that all businesses that are subject to the law's beneficial ownership information (boi) reporting.

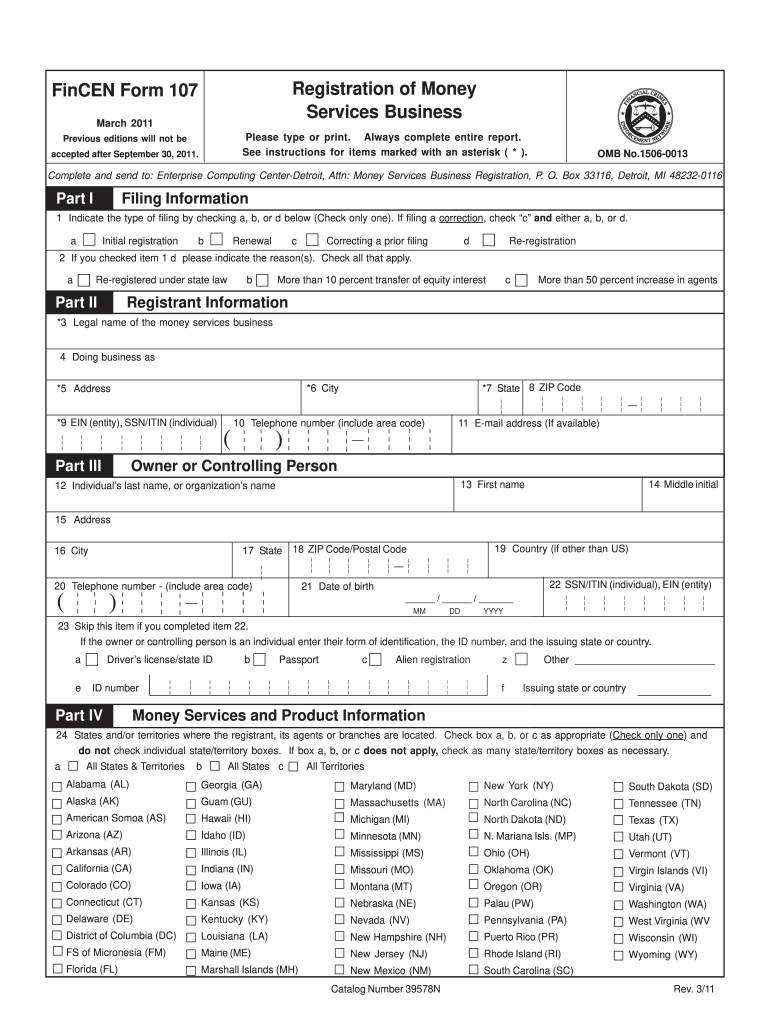

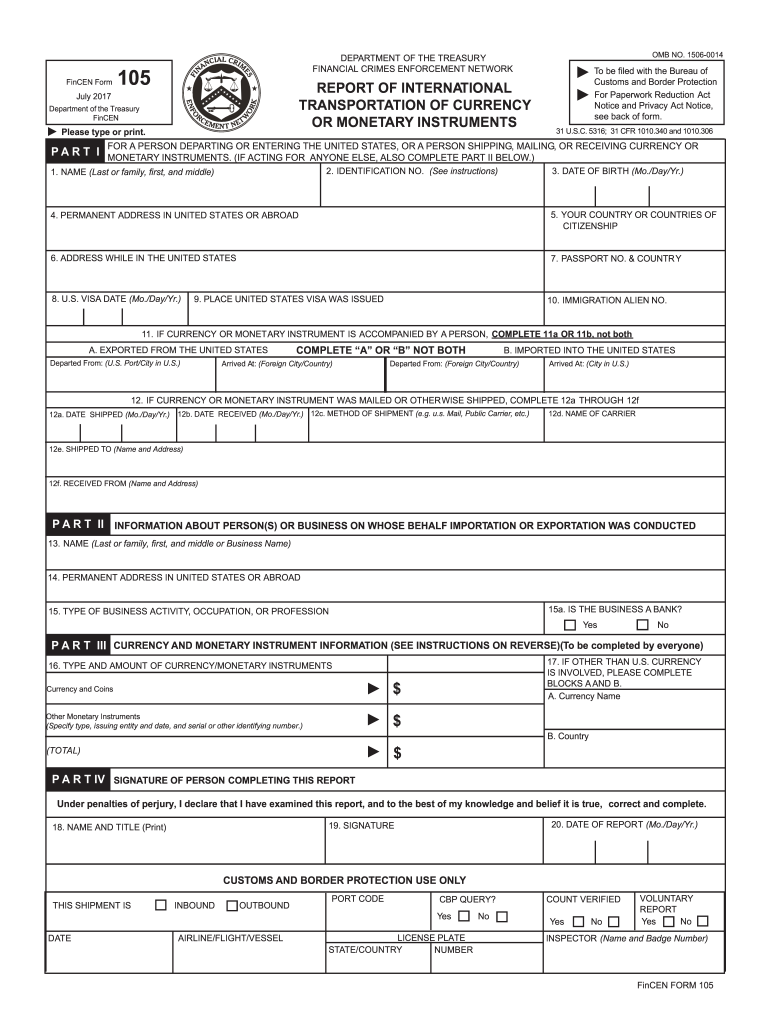

How to File BOI Report with FinCEN Example for Single Member LLC, If you are required to report your company's beneficial ownership information to fincen, you will do so electronically through a secure filing system availab.

Fincen services online Fill out & sign online DocHub, Companies that are required to comply (“reporting companies”) must file their initial reports by the following deadlines:

All You Need To Know About Beneficial Ownership Information Reporting, Companies created in 2025 have 90 days from their creation date to file boi reports, while the deadline for companies created before 2025 is jan.

BOI Filing How to File BOI Report Online for 2025, Fincen’s final rule imposes aml/cft program requirements on registered investment advisers and exempt reporting advisers.

How To File The BOI Report With FINCEN Correctly! YouTube, Starting in 2025, many entities created in or registered to do business in the united states will be required to report information about their beneficial owners—the.

Fincen 20172024 Form Fill Out and Sign Printable PDF Template, Beneficial ownership information (boi) reports must be filed through fincen’s secure filing system.

New 2025 FINCEN Reporting for LLC, 500 a Day Fines File BOI Report, Filing is simple, secure, and free of charge.